Subsection 44 6 2. CYBERJAYA March 26 Tax deduction incentives will be given to those who donate cash or items that will be used to contain the spread of Covid-19 and to help the people affected by the outbreak said Inland Revenue Board IRB.

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Institution or organization to obtain income tax exemption under subsubparagraph 131b of Schedule 6 to the ITA pursuant to the Income Tax Exemption Order 2017 PUA 522017.

. A part of your income from a business employment or even royalties is taxable to the government. If you are a one-time donor you will receive a donation receipt from UNICEF for every donation you make. Contributors with business income are entitled to a deduction from gross business income on the contributions made.

Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia LDHN whereby taxpayers are allowed to deduct a certain amount of money from their income tax. Some types of assistance include life insurance medical expenses for parents individual education fees the purchase of a laptop or smartphone. Which is established in Malaysia exclusively for the purpose of religious worship or the advancement of religion and is not operated or conducted primarily.

For every donation of RM50 and above it is also tax exempt under Section 446 of the Income Tax Act 1967. Gift of money or cost of contribution in kind for any Approved Sports Activity or. Tax-deductibles reduce the amount you have to pay the government.

Yes WWF-Malaysia is an NGO under sub-section 44 6 of Income Tax Act 1967 and all cash donations to WWF-Malaysia are tax deductible applicable only to donations made within Malaysia. However since you are eligible for the individual tax rebate RM400 off tax. Is my donation tax exempted.

Donations to PAWS Animal Welfare Society are tax-exempted under Subsection 446 of the Income Tax Act 1967 effective 15 November 2019. With cash donations MERCY Malaysia is able to purchase supplies in local regions or closer to the affected areas. Tax Exemption Receipt shall only be issued to the personcompany that makes payment name appearing on the cheque or direct bank-in for.

Gift of money or cost of contribution in kind for any Approved Sports Activity or Sports Body. Amount is limited to 10 of aggregate income Subsection 44 6 3. This means among other things that the Catholic Church doesnt pay.

What is the supporting document needed for tax relief and tax deduction for cash donation under paragraph 346h of the. Payments to foreign affiliates. This brings your chargeable income down to RM33500 so you are taxed a total of RM555.

14 Income remitted from outside Malaysia. LIST OF GUIDELINES UNDER SUBSECTION 44 6 OF THE INCOME TAX ACT 1967. Gift of money to Approved Institutions or Organisations.

Garis Panduan Permohonan Untuk Kelulusan Ketua Pengarah Hasil Dalam Negeri Malaysia Di Bawah Subseksyen 44 6 Akta Cukai Pendapatan 1967 Bagi Tabung Pembelian Sekolah Agama Bertarikh 28 April 2021. A Malaysian company can claim a deduction for royalties management service fees and interest charges paid to foreign affiliates provided that these are made at arms length and the relevant WHTs where applicable have been deducted and remitted to the Malaysian tax authorities. UNICEF Malaysia adheres to a strict policy regarding donor.

However for donations above RM5000 in a single. Will my credit card and bank account information remain confidential. You are entitled to tax exemption for all cash donations as defined under sub-section 44 6 of Income Tax Act 1967 Government.

And still be entitled to a tax-exempt receipt. Essentially taxable income is your total annual income minus all the tax exemptions tax deductibles and tax reliefs that youre entitled to. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

As it was from AD. In tax reliefs you claim RM9000 for automatic individual relief and RM2500 for lifestyle expenses. The IRB in a statement today said the incentives provided under the Income Tax Act 1967 were for the Ministry of.

Gift of money to the Government State Government or Local Authorities. As a token of appreciation and to encourage the rakyat to make contribution it has been announced that tax deductions will be given to donors who donate cash or goods that will be used to tackle the Covid-19 pandemic and to help those. Of The Income Tax Act 1967 List Of Guidelines Under Subsection 446 Of The Income Tax Act 1967.

The only solution for such organisations to be exempt from tax is to apply for approval under Section 44 6 of the Income Tax Act 1967 ITA which will automatically exempt the charitable organisation from income tax and allow donors to claim a tax deduction up to 10 of their aggregate income on all sources. Tax Exemption Guidelines under Subsection 446 Income Tax Act 1967. By Ministry of Health Malaysia.

For example if you take up a job while overseas and you only receive the payment for the job when you are back in. Is there a minimum amount of donation required for me to be eligible for tax-exemption. Who can contribute donate under paragraph 346h of the ITA 1967.

306 to 337 in Rome under Emperor Constantine the Catholic Church has been free from the obligation to pay income tax to the United States federal government ever since the country was founded and it received official tax exemption status in 1894. Without a tax rebate RM555 would be the amount of tax that you have to pay. List Of Guidelines Under Subsection 446 Of The Income Tax Act 1967.

PERSATUAN MENCEGAH SALAH GUNA DADAH MALAYSIA PEMADAM 8 JALAN LEDANG50480 KUALA LUMPUR Kuala Lumpur 1976-03-21 PERSATUAN PENJAGAAN.

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Can I Get A Tax Exemption Receipt For My Donation Incitement Support

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

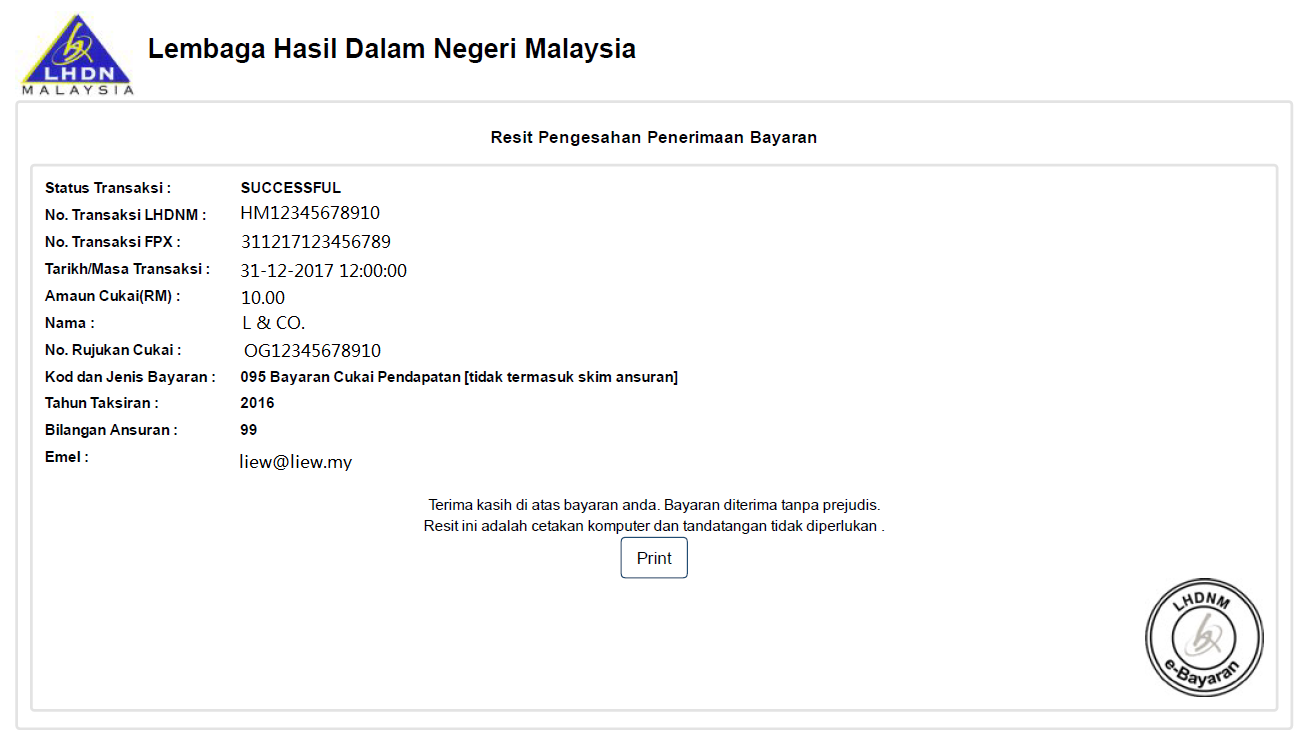

Tips For Income Tax Saving L Co Chartered Accountants

Updated Guide On Donations And Gifts Tax Deductions

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Chapter 4 Consumer Mathematics Taxation Flip Ebook Pages 1 28 Anyflip

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Tips For Income Tax Saving L Co Chartered Accountants

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Updated Guide On Donations And Gifts Tax Deductions

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog